Growth in the emerging markets and developing economies in Europe and Central Asia (ECA region includes 22 countries) has slowed. However, the region has remained resilient amid continued global and regional challenges, according to the World Bank’s latest Europe and Central Asia Economic Update: Jobs and Prosperity, released this week.

Economic outlook for the ECA region

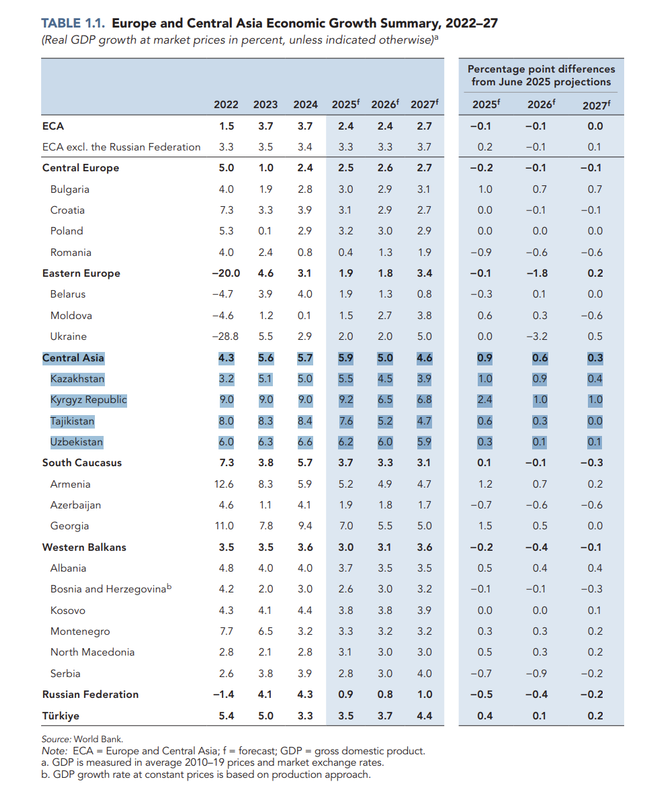

Regional GDP is likely to grow by 2.4 percent in real terms this year, down from 3.7 percent in 2024, driven primarily by a weaker pace of expansion in the Russian Federation. Excluding Russia, which accounts for about 40 percent of the region’s output, growth is likely to remain little changed at about 3.3 percent this year and next.

Growth in ECA is expected to pick up only modestly to 2.6 percent on average in 2026–27. In Russia, growth is likely to weaken further to 0.8 percent next year before picking up slightly to 1 percent in 2027. In contrast, economic expansion in Türkiye is expected to continue gaining momentum, with growth reaching 4.4 percent in 2027.

Private consumption, supported by wages, remittances, and social transfers; continued infrastructure spending; and a gradual recovery in trade outside Russia are likely to sustain growth across the region.

Nonetheless, there are substantial downside risks. Slow progress in advancing structural reforms has limited the scope for productivity growth to rebound and convergence to high income status to accelerate. Trade and geopolitical tensions and persistent inflation pressures have also heightened the region’s vulnerabilities.

Economic outlook for the Central Asian countries

The pace of economic expansion in Central Asia—ECA’s fastest growing subregion for the third consecutive year—is projected to firm to 5.9 percent in 2025 from 5.7 percent last year. It is driven by higher oil output in Kazakhstan, stronger remittances in the Kyrgyz Republic, Tajikistan, and Uzbekistan, as well as higher public and private investment spending across the subregion.

According to forecasts, economic growth in Central Asia is expected to slow to 5% in 2026. Nevertheless, the countries of the subregion will remain among the leaders in GDP growth across Europe and Central Asia, including the subregions of Central and Eastern Europe, the South Caucasus, the Western Balkans, as well as Russia and Türkiye.

Uzbekistan is expected to remain among the five fastest-growing economies in the ECA region in both 2025 and 2026. The country’s GDP growth is projected at 6.2% in 2025 and 6% in 2026. Other growth leaders include the Kyrgyz Republic (9.2% in 2025 and 6.5% in 2026), Tajikistan (7.6% and 5.2%, respectively), Georgia (7% and 5.5%), and Kazakhstan (5.5% and 4.5%).

Jobs in the ECA region

In a special focus on jobs, the World Bank report finds that investing in infrastructure, improving the business environment, and mobilizing private capital will be critical to jumpstarting productivity.

Countries need to begin by investing in the foundation for jobs – physical and human infrastructure. Improving the quality of education, particularly vocational and higher education, is also necessary. There is still untapped potential among women and young people, who are underrepresented in the labor force.

Promising sectors for job creation in Central Asia

The World Bank report notes that removing existing barriers to the development of specific economic sectors in Central Asian countries will help create new jobs.

Namely, in Kazakhstan, there are untapped agroprocessing opportunities in wheat and livestock. The Kyrgyz Republic combines hydropower and emerging solar potential with tourism niches (soft adventure and winter), and a set of export-oriented services in finance, tourism, and information and communication technology (ICT).

For Tajikistan, opportunities lie in leveraging the country’s enormous hydropower potential, improving corridor logistics and border processes, and expanding tourism.

Uzbekistan’s priorities span chemicals manufacturing, ICT services, and horticulture. In the chemicals sector, competitiveness and energy efficiency gains depend on modernizing the industry and separating regulatory and control functions from commercial operations, while gradually removing subsidies, price ceilings, and export controls.

Uzbekistan’s ICT potential is limited by gaps in broadband coverage and affordability. Horticulture can scale exports by adopting global standards and certification, eliminating prepayment requirements for exports, and accelerating investment in modern irrigation and crop research and development (R&D).