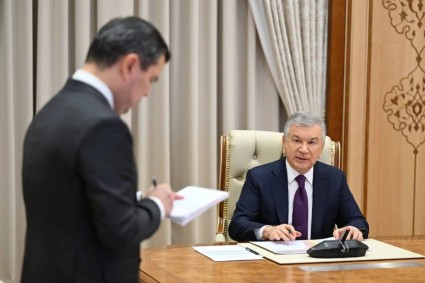

Jamshid Kuchkarov has been a steady hand on the tiller during what has been one of the most rapid programmes of economic liberalisations in recent memory. After years spent held back by the strictures commonly left behind in former Soviet states, Kuchkarov was trusted by the reformist President Mirziyoyev to manage the liberalisation of the currency markets, a lightening of trade restrictions, and the country’s international bond market debut

Some reforms have come easily. “When liberalising the FX rate, or improving statistical disclosure, it’s a pleasure — everyone is happy about it,” says Kuchkarov.

But the government has also taken aim at Uzbekistan’s somewhat bloated array of state-owned enterprises, with an eye to preparing them for privatisation and ensuring their regulatory functions are separate from their business roles.

Kuchkarov says the changes are necessary both for efficiency and transparency, but that does not mean they are always popular. “When restructuring companies, particularly energy companies, sometimes that involves the removal of subsidies and increases energy prices. There are different opinions on this — some in support, some against”

Managing the response and ensuring the goodwill of the people is, for the government, just as important a task as ensuring fiscal and macroeconomic stability. “One of our main responsibilities is to engage with the media in all sorts of ways to promote a better understanding of the necessity of the reforms and the benefits they’ll bring,” says Kuchkarov.

The reduction of income tax to a fiat rate of 12% is a popular measure, but quite apart from that, Kuchkarov says that the decision is key to “stimulating Uzbekistan’s value chain”.

GDP growth is steady — above 5% — rather than the dynamic and volatile heights of the early 2010s, but forecasts are for this to increase in the next few years.

But in spite of the high ambitions of the reform programme, the country is running only a small budget deficit — something that provides the international investment community with confidence as they analyse the credit of one of the newest entrants to global capital markets.