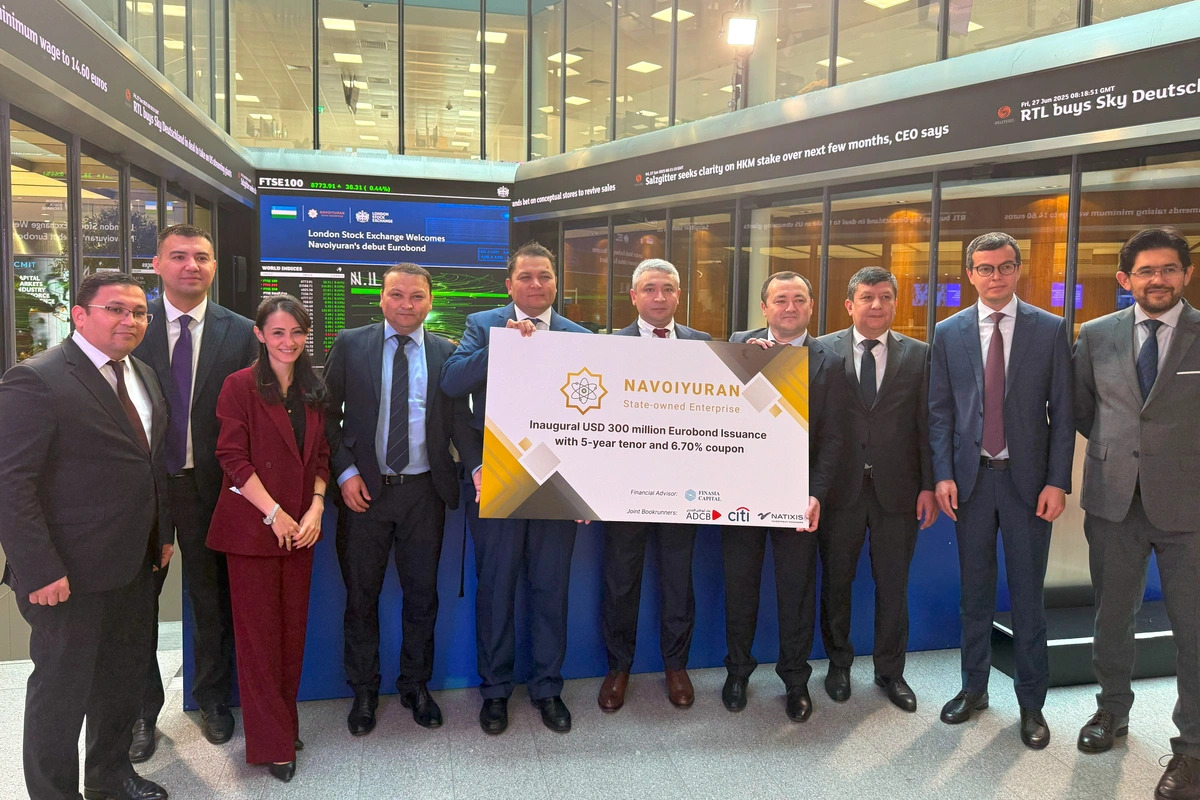

The state-owned uranium producer NavoiyUran announced that it had successfully priced its inaugural$300 million Eurobond issuance with 4-year tenor and 6.7% coupon.

This is the first global debt capital markets issuance from the Uzbek uranium mining company.

Ahead of the transaction, NavoiyUran obtained the company’s credit ratings by S&P and Fitch, both capped at the sovereign level of BB-.

CITI, Abu Dhabi Commercial Bank and Natixis acted as underwriters of the issuance. Finasia Capitals was chosen as the financial consultant, the international company Dentons was the legal consultant, and the audit was conducted by Deloitte.

On June 23-24, Navoiyuran officials held meetings with 64 major international investors in London, where they spoke about reforms within the framework of the New Uzbekistan concept, the transformation of the enterprise in 2022-2024 and plans for further development.