Fitch Ratings has affirmed Uzbekistan’s Long-Term Foreign- and Local-Currency Issuer Default Ratings (IDR) at ‘BB-’. The Outlook is Stable.

Uzbekistan’s ratings balance a robust sovereign balance sheet, low government debt and a record of high growth relative to rating peers against high commodity dependence, high inflation and structural weaknesses in terms of low GDP per capita and weak institutional and governance levels relative to rating peers, the agency said.

Fitch Ratings added that the government is committed to reforms that seek to improve macroeconomic stability and growth prospects, as well as addressing institutional and governance weaknesses in what was a heavily state-controlled economy.

The authorities remain committed to greater exchange rate flexibility and a reduction in inflation, after earlier liberalisation of the FX market. However, monetary policy effectiveness is constrained by the high level of financial dollarisation (37.4% of deposits and 56.5% of credit), high share of public-funded credit below market rates (50% of outstanding loans), underdeveloped local capital markets and the short track record of the new policy framework. Improving coordination between attaining monetary policy goals and the financing of state projects and programmes will be key to strengthening monetary policy and reducing risks to macroeconomic stability. Fitch expects inflation to average 15.2% in 2019, down from 17.9% in 2018, and slow to 13.5% in 2020, significantly above the projected 4% ‘BB’ median.

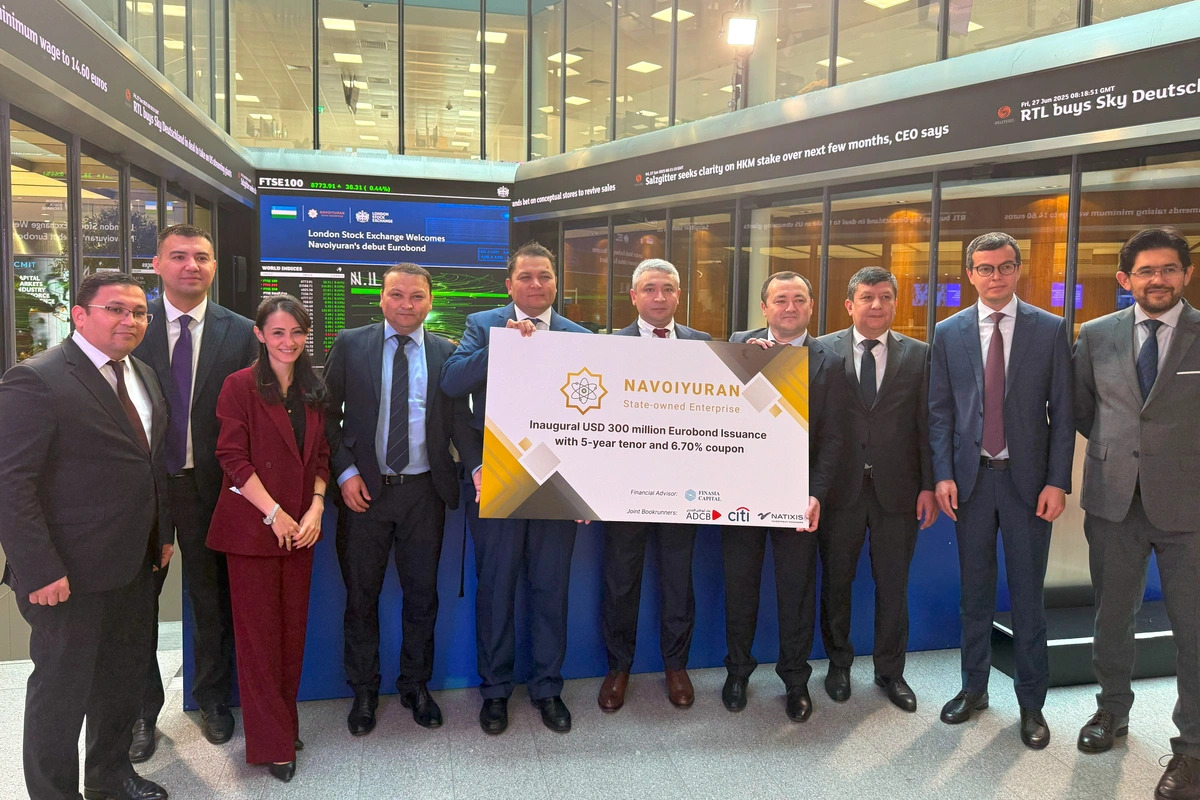

Rapid credit growth directed to government investment projects has led to a high current account deficit. Fitch has assigned a Uzbekistan a Macro-Prudential Risk Indicator (MPI) of 2, indicating moderate vulnerability due to fast net credit growth (50% yoy in 2018) funded by public sector sources such as the Uzbekistan Fund for Reconstruction and Development (UFRD) and external borrowing. While the authorities intend to rein in credit growth to 25% in 2019, Fitch considers that upside risks remain material given the availability of funding sources including the UFRD, the proceeds of Eurobonds issuance deposited in state-owned banks (83% of system assets) and access to external financing, Fitch Ratings said.

The current account deteriorated to a deficit of 7.1% in 2018 from a surplus of 2.5% in 2017, reflecting rapid import growth (67% yoy for capital imports) as well as the removal of FX and current account restrictions. Continued strong domestic demand, public sector investment projects and likely slower demand from key trade partners will maintain a deficit at 7.1% in 2019 before declining to 5.9% in 2020. Large current account deficits, if sustained, will lead to increased vulnerability to external financial or commodity shocks and higher external indebtedness, the agency underlined.

Fitch Ratings said that near-term risks derived from the high current account deficits are mitigated by increased external financing availability, the sovereign external balance sheet strength in relation to rating peers and low financing needs. Sovereign net foreign assets will decline to 25% of GDP in 2019, down from 34% in 2018, but will remain stronger than the -1% ‘BB’ median. Gross international reserves will finish 2019 close to the end-March level of USD27.6 billion, maintaining robust reserve coverage of 11.9 months of CXP in 2019 and 11 months in 2020, more than double the forecast ‘BB’ median. External liquid assets as a share of short-term liabilities, at 329% in 2019, are among the highest in the ‘BB’ category.

The UFRD underpins the sovereign’s external and fiscal financing flexibility, in addition to supporting strategic investment projects, state-owned enterprise (SOE) financing and funding for state-owned banks. The UFRD’s total assets were USD18.5 billion in 3Q18, and a high share of international reserves (39% or USD11 billion) consist of UFRD cash holdings; the CBU’s share of international reserves’ holdings consist mostly of gold.

General government debt was 20.8% of GDP (including 5.2% in external guarantees) in 2018, and Fitch forecasts debt to increase to 23.3% in 2019, still well below the current ‘BB’ median of 45%. The structure of debt is favourable in terms of maturity and costs (83% to multilateral and bilateral creditors), but currency risk is high (99% foreign currency denominated).

Fitch forecasts the consolidated budget (including regional governments and off-budget funds such as social security) to average 1% of GDP deficits in 2019 and 2020, after a 0.5% surplus in 2018, reflecting the implementation of the tax reform, targeted public sector salary and social spending increases. Fitch projects off-budget spending through UFRD investment and directed credit (primarily for housing development, strategic infrastructure and industrialisation projects) to decline to 2.7% and 2.5% of GDP in 2019-2020, from 4.3% of GDP in 2018, which will lead to an augmented deficits of 2.6% and 2.3% of GDP, respectively. These projected deficits are in line with the forecast ‘BB’ median.

Key SOE reforms include the separation of business and regulatory functions, unbundling of business lines and developing corporate governance in the energy and transport sectors. Bringing utility tariffs closer to market levels is key to reducing SOEs’ reliance on cheap financing, reducing fiscal and financial risks, and eventual privatisation of non-strategic assets. Reducing SOE dependence on public sector funding could in turn provide space for reform in the large state-owned banking sector.

Fitch forecasts growth to reach 5.0% in 2019 and accelerate to 5.5% in 2020, continuing to outperform the forecast growth for the current ‘BB’ median. Growth will be driven by government investment in strategic projects, housing and infrastructure expenditure and private consumption. Long-term growth potential is underpinned by favourable demographics and a rich natural resource endowment.

Uzbekistan’s commodity dependence (60% of goods exports and 37% of budget revenues) is higher than peers and the country’s structural credit weaknesses are reflected in low GDP per capita and weaker governance indicators, as measured by the World Bank, relative to ‘BB’ peers. A fast-moving, complex and broad reform agenda create some risks regarding coordination and institutional capacity of the public administration to effectively plan and execute policy measures while minimising economic distortions, in Fitch’s view, the agency said.

Despite the current strong commitment of the political leadership to the reform agenda, Fitch considers that the delay in the materialisation of its benefits in terms of higher growth, increased private investment and employment creation in combination with greater-than-expected social costs could cause reform fatigue, although this would be unlikely to impact social stability.