On June 22, the Judicial Collegium for Economic Affairs of the Supreme Court of Uzbekistan considered the case of the founders of the Tashkent Metallurgical Plant (TMZ) producing cold-rolled steel with galvanized and polymer coatings.

The Uzbekistan Fund for Reconstruction and Development (49.9%) filed a lawsuit against the Cypriot offshore companies Metalloinvest Holding (Cyprus) Limited (41.87%) and Miramonte Investments Limited (8.23%), which together owned a controlling stake in TMZ.

The UFRR asked the court to remove the defendants from among the founders of Toshkent Metallurgiya Zavodi LLC, registered on January 26, 2017. On February 24, 2022, the company received the status of a joint venture.

In support of the stated claim, the plaintiff indicated that the plant was currently experiencing financial issues. In 2022 financial year, the net loss topped 316.8 billion soums, or US$ 28 million and the accumulated loss for 2017-2022 stood at 916.92 billion soums, or US$ 79.5 million, and therefore, in order to improve the financial condition of the enterprise, it is necessary to take urgent measures.

In particular, the founders must approve the business plan for 2023, as well as extend the repayment periods for previously drawn loans that have already expired, the document says.

While, it is also necessary to attract additional funding from the Russian company "International Financial Technologies XXI" with an authorized capital of 10 thousand rubles (about $111), which specializes in providing loans and other types of credit. We are talking about the amount of 1.5 billion rubles (16.7 million dollars) for a period of 24 months with an interest rate equal to the key rate of the Central Bank of Russia (7.5%).

Meanwhile, it is planned to pledge the property of the plant in accordance with the terms of the syndicated loan agreement dated October 24, 2018 and resolve other issues.

A majority vote is required to approve these measures. The non-participation of other founders in the general meeting leads to the absence of a quorum for the meeting and, accordingly, the impossibility of making a decision on the agenda of the meeting, the document says.

On April 19, TMZ sent a notice to all founders, including the defendants (Metalloinvest Holding and Miramonte Investments), to convene the next general meeting of participants with a list of issues on which it is critical to make decisions. On May 2 and 5, several notices were sent to the heads of these companies (defendants) via corporate mail.

Oskol Electrometallurgical Plant JSC (OEP, a subsidiary of Metalloinvest, owned by the USM holding, one of the owners of which is billionaire Alisher Usmanov), which owns 100% of the shares of the Cypriot Metalloinvest Holding, notified in its letter of May 5 that the defendant refuses to participate in the activities of the joint venture including participation in general meetings of the company's members.

As noted in the court decision, the OEP did not object to her expulsion from the company owners.

The second defendant, Miramonte Investments (the US Department of the Treasury reported that the company is associated with Alisher Usmanov) has not participated in the activities of the joint venture, including in general meetings of the company's participants, since March 2022, and has been leaving the company's letters unanswered.

“The inaction of the defendants makes it impossible to take the most important decisions for the company to implement measures for financial recovery, which, in turn, makes it impossible for the company to perform obligations to creditors and, in fact, puts the company at risk of bankruptcy,” the FRRU lawsuit says.

On June 12, the Judicial Collegium for Economic Affairs of the Tashkent City Court satisfied the claim, and the Cypriot companies were removed from the founders of the plant. Court costs in the amount of 3.3 million soums were also collected from the defendants in solidarity in favor of the plaintiff.

The FRRU filed an appeal against the decision of the court, in which he asked to change the decision regarding the distribution of court costs and recover court costs from JV LLC TMZ. In support of this, the complaint states that the defendants are residents of Cyprus, Uzbekistan does not have a bilateral agreement on mutual legal assistance with this state, and therefore it is not possible to enforce a court decision regarding the recovery of court costs in Cyprus.

However, the court of appeal considered that the plaintiff's argument could not serve as a basis for attributing court costs to the joint venture under Article 118 of the Economic Procedure Code, and on June 22 upheld the decision of the first instance court.

"Big plans"

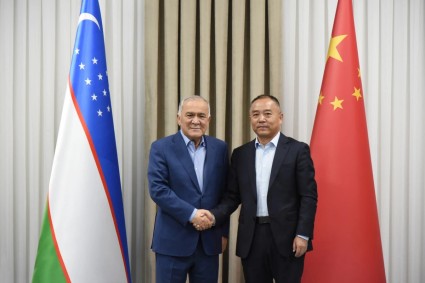

In early December 2020, President Shavkat Mirziyoyev attended the launch ceremony of the Tashkent Metallurgical Plant.

The total amount of capital investments in the project is estimated at more than 334.5 million euros, of which 164.56 million euros is a loan from the Russian Export-Import Bank for 10 years, 154.7 million euros are own funds (about half are the Fund for Reconstruction and Development) , 15.1 million euros - a loan from Asaka Bank. The estimated payback period was about 8.6 years. Initially, the total cost of the project was estimated at 278.2 million euros, but after making changes to the project in order to expand production capacity, it increased, as did the payback period, to 9.3 years.

The project for the construction of the plant on an area of 49.7 hectares was carried out by the Russian Metprom group on a turnkey basis, that is, the group acted as the designer and general contractor of the project. The enterprise is equipped with technologies and automated equipment of the Italian Danieli.

The project implementation was managed by a foreign company SFI Management Group, which fully supervised all stages of construction and commissioning, including project development, negotiations with all interested parties, attracting investments, loans and recruiting foreign specialists.

TMZ products were planned to be used in the construction industry (production of metal tiles, air ducts, sandwich panels, bent profiles, light steel thin-walled structures), in the production of household appliances (manufacturing of cases) and mechanical engineering (production of car body parts).

President Shavkat Mirziyoyev stated that with the launch of the plant, a chain of production of metallurgical products that are in demand in Uzbekistan will be formed, and the level of localization will significantly increase at domestic enterprises. It was expected that the launch of the plant at the first stage would prevent the outflow of foreign currency by 400 million dollars annually.

According to the Agency of Statistics, in 2021 Uzbekistan imported cast iron and steel for $2.09 billion, metal products for $577.7 million. At the end of 2022, these figures increased to $2.5 billion and $730.8 million, respectively.

Since then, the construction of a casting and rolling complex at Uzmetkombinat JSC has also been underway (cost - $ 800 million). With its commissioning, together with the TMZ, it is planned to create a "metallurgical cluster".

Founders

Initially, the founders of the JV "Tashkent Metallurgical Plant" with an authorized capital of 197.8 million euros were the Uzbekistan Fund for Reconstruction and Development (49.9%, or 98.7 million euros) and the Dutch Metallurgical Technology and Engineering B.V. (50.1%, 99.1 million euros).

SFI Management Group (Alisher Usmanov in an interview with Forbes said that the company belonged to the family of billionaire Fattah Shadiev's brother, Kabul Shadiev, who was present at the opening of TMZ and made a presentation to the president), which managed the project, proposed to become participants in the project.

The restructuring of the founders was due to a decrease in the share of Metallurgical Technology and Engineering B.V. up to 41.9%. SFI Management Group received 8.2%.

On April 25, at an industrial exhibition in Tashkent, the general director of Metalloinvest, Nazim Efendiev, announced that the company "invested and entered the capital of TMZ." Metalloinvest Holding (Cyprus) Limited became the owner of a 41.8% share instead of the Dutch Metallurgical Technology and Engineering B.V., and the Cypriot Miramonte Investments Limited - 8.2% instead of SFI.

Metalloinvest and Miramonte Investments came under US sanctions in April.

Until June 30, 2020, the import of rolled iron or non-alloy steel with a width of 600 mm or more (HS codes 7210 49 000 0 and 7210 70 800 0) was not subject to customs duties. Then a rate of 10% of the customs value of the goods was introduced. Now the rate is 10%, but not less than $0.25 per 1 kg.