The World Bank has releasedthe latest Europe and Central Asia Economic Update, assessing the economic situation in over 20 developing economies of Central and Eastern Europe, the Western Balkans, Central Asia, and the South Caucasus, as well as in Türkiye and Russia.

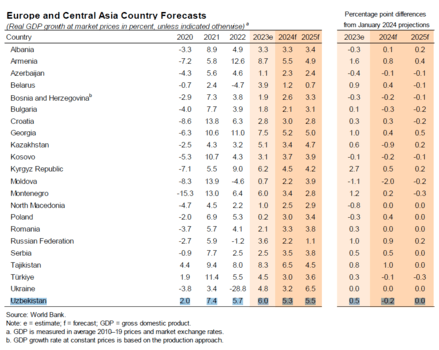

According to the report, Uzbekistan’s economy increased by 6% in 2023 and is projected to grow by 5.3% in 2024. This year, the country is expected to reach the ranks of the top five fastest-growing economies in the Europe and Central Asia region, along with Tajikistan (6.5%), Armenia (5.5%), Georgia (5.2%), and the Kyrgyz Republic (4.5%).

Recent economic developments

Uzbekistan’s real GDP grew by 6 percent in 2023, led by investment, private consumption, and exports. Faster investment growth was facilitated by credit growth to state-owned enterprises (SOEs) and the private sector. Real credit (loans to SOEs and the private sector) grew by 11.6 percent between 2022 and 2023, up from 5.1 percent between 2021 and 2022.

Consumer price inflation fell to its lowest level in seven years, dropping to 8.8 percent YoY in December 2023, compared to 12.3 percent in 2022. This was driven by sustained, tight monetary policy, as well as a VAT tax rate cut and lower international food and energy prices.

In 2023, the Uzbek som depreciated by 9 percent against the US dollar (USD), in part due to a flow-on effect of the depreciation of the Russian ruble (a close trading currency) against the USD.

The current account deficit deteriorated as import growth accelerated and remittances declined in 2023 (the latter was related to the ruble’s depreciation).

Uzbekistan’s gas exports dropped by half, and amid rising domestic gas needs, Uzbekistan began importing gas from Russia in 2023 for the first time.

The fiscal deficit expanded from 4.1 percent in 2022 to 5.8 percent of GDP in 2023 due to emergency spending on energy infrastructure and fuel during the cold winter, higher spending on salaries and social benefits, energy subsidies, and subsidized lending to SOEs via state-owned banks.

Foreign reserves remained ample at $34.6 billion by December 2023, more than 8 months of prospective imports.

Robust real wage growth contributed to reducing poverty from 5.0 percent in 2022 to 4.5 percent in 2023, measured at the lower-middle income poverty line (USD 3.65/day, 2017 PPP).

The unemployment rate has dropped to 8.1 percent in 2023, down from 8.9 percent in 2022.

Average real wages in 2023 increased by 7.8 percent not only due to growing demand but also because of skills shortages in the labor market. As a result, wage growth was higher among the more skilled (and wealthier) workers than among the poor, resulting in higher income inequality.

Economic outlook

Uzbekistan’s GDP growth is projected at 5.3 percent in 2024 given the expected fiscal consolidation and slower export growth prospects to Russia and China, Uzbekistan’s key trading partners. Growth will be supported mainly by the continued implementation of structural reforms, notably SOEs’ restructuring and privatization, and high energy sector investment.

Inflation is expected to increase in 2024 due to relatively sharp increases in domestic energy prices because of the energy tariff reforms (accompanied by social protection measures). This will be partially offset by a continued tight monetary stance while the Central Bank of Uzbekistan (CBU) completes its transition to full inflation targeting. Inflation is expected to decelerate to 8 percent in the medium term, higher than the CBU target of 5 percent.

Import growth is expected to moderate in 2024 but remains buoyant as imports support both economic modernization and growing consumption.

Remittances in 2024 are projected to decline mainly due to an expected reduction in the number of labor migrants to Russia. With decreasing remittances and strong imports, the current account deficit will widen slightly but remain sustainable as Uzbekistan’s transformation process brings in foreign savings to finance the deficit.

This economic outlook is expected to reduce poverty moderately to 4.3 percent in 2024, measured at the lower-middle income poverty line (USD 3.65/day, 2017 PPP).

The fiscal deficit is expected to fall to 4.2 percent of GDP in 2024 and towards 3 percent of GDP by 2026 as large, untargeted energy subsidies and ineffective incentives to SOEs are withdrawn, and thanks to growing budget revenues amid privatization proceeds.

The government is expected to adhere to its debt limits (60 percent of GDP for total Public and Publicly Guaranteed debt), with public debt lightly increasing to 36.5 percent of GDP in 2024 and then gradually declining to 34.4 percent of GDP by 2026.

Risks to the outlook are tilted to the downside. External risks include possible deterioration of growth in key trading partners, notably China and Russia, and further tightening of external financial conditions.

Domestic risks stem from the growing contingent liabilities from SOEs, public-private partnerships, and state-owned banks.

Upside risks include higher global gold and copper prices and stronger productivity growth due to ongoing structural reforms.